Monthly Archives: May 2025

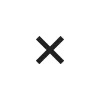

Yen Slides as U.S.-China Trade Deal Boosts Risk Appetite

Written on May 14, 2025 at 9:31 am, by

Key Takeaways: *Risk-on rally: U.S.-China tariff truce triggers global risk appetite, reducing demand for safe-haven yen. *BoJ remains dovish: Weak wage and spending data support continued ultra-loose policy. Market Summary: The Japanese yen weakened sharply as risk sentiment surged following a breakthrough in U.S.-China trade negotiations. Both nations agreed to significantly reduce tariffs for atContinue Reading

Renewed optimism after US-China trade deal signals, Boosts Dollar

Written on May 14, 2025 at 9:31 am, by

Key Takeaways: *Dollar Index rallies on renewed optimism after US-China trade deal signals *Gold prices fall sharply as safe-haven demand weakens amid easing geopolitical tensions. Global risk appetite strengthened significantly as geopolitical tensions showed signs of easing, particularly between the United States and China. The White House announced that a trade agreement with China hadContinue Reading

U.S.-China Trade Deal Boosts Equity Market

Written on May 14, 2025 at 9:30 am, by

Key Takeaways: *U.S. equity futures jump after the White House confirms a preliminary trade deal with China following talks in Geneva. *Risk appetite rises globally, aided by signs of de-escalation in the U.S.-China tensions and a ceasefire agreement between India and Pakistan. Global markets kicked off the week on a bullish note as U.S. stockContinue Reading